€

€

€

+50.000 downloads

Supported by research and healthcare professionals

4.8/5 rating based on over 1,000 reviews on the Play Store & App Store

+65% revenue growth in two years

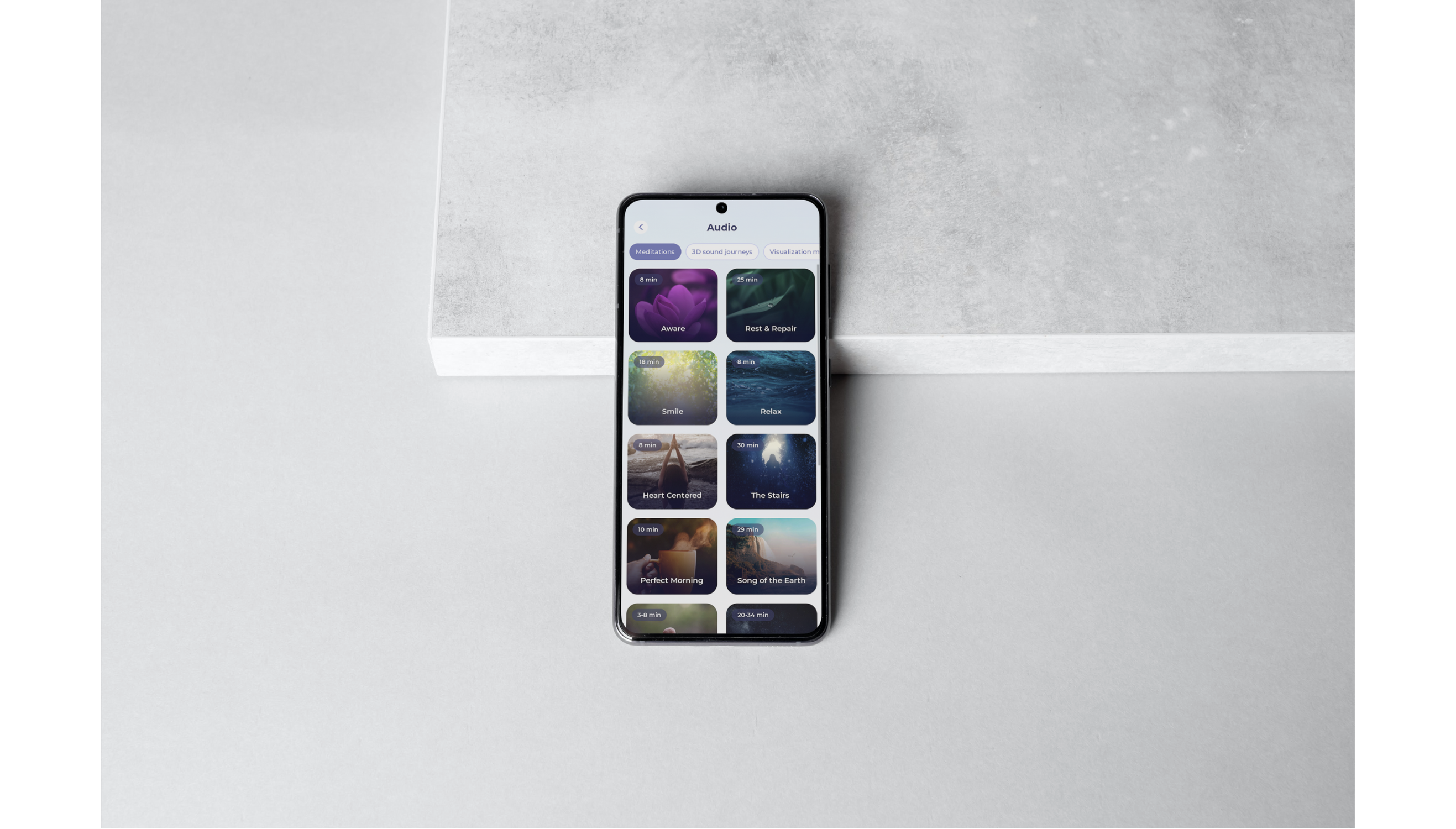

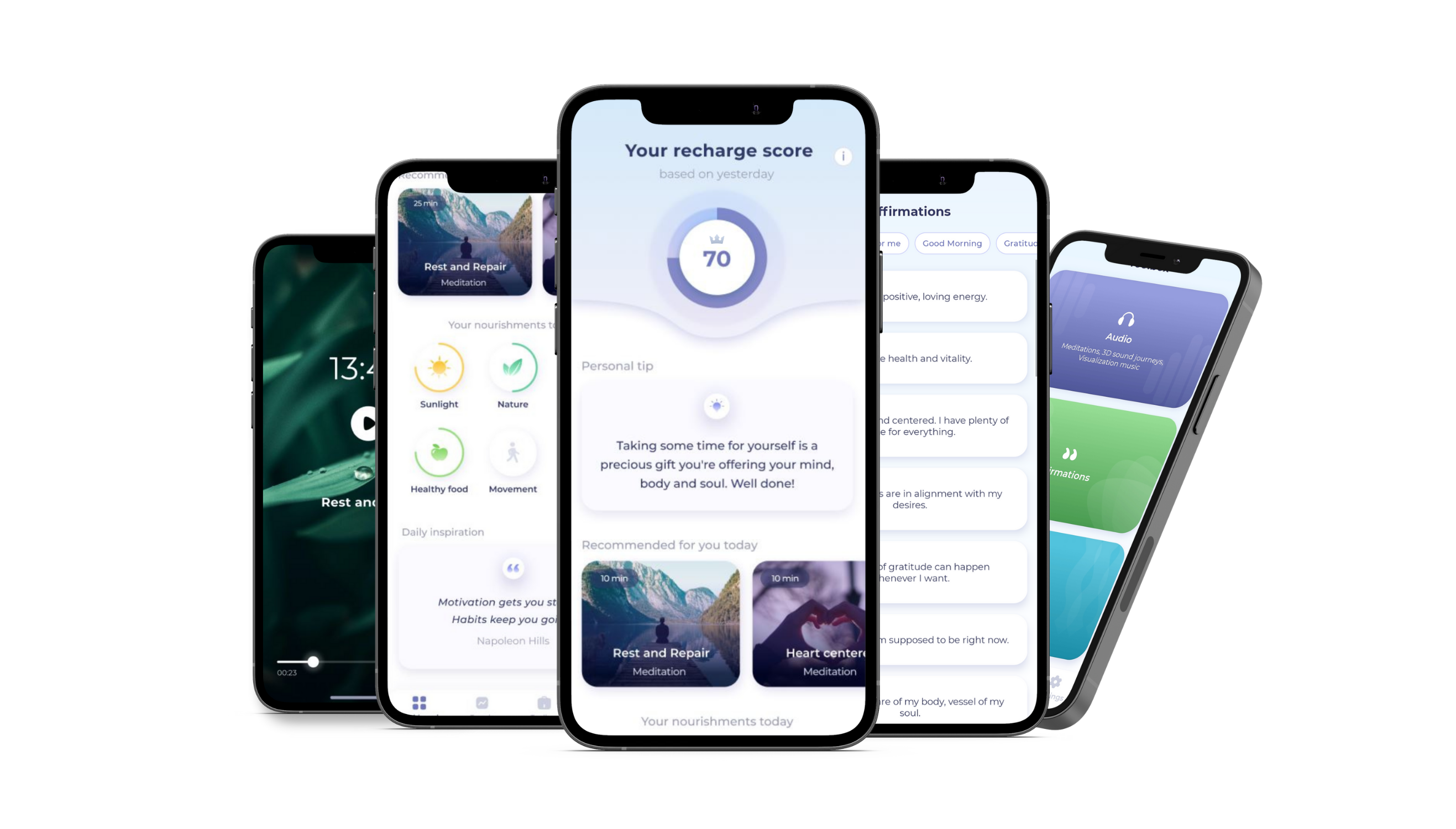

A complete health platform with online programs, a mobile app, and retreats.

Investments from €1.000 with a 7% interest rate

More information: www.envol-mind.com

JOIN NOW!

A bond investment is essentially a loan issued by a company. When you buy a bond, you are lending money to that company. In return, you receive interest payments, and the loan is repaid over a defined period.

With this option, you have the assurance that a payout takes place every quarter. This way, your investment gradually returns to you, with an attractive return.

A complete health platform

Envol is a fast-growing wellness company based in Rotterdam, The Netherlands, and Toulouse, France. Through a combination of a mobile app, online programs, and healing retreats, Envol helps individuals with chronic symptoms or sensitive health conditions reconnect with their bodies.

What makes Envol unique is its focus on activating the body’s innate healing potential, using tools grounded in neuroscience and psychology to help the nervous system return to balance, allowing the body to restore itself at its own pace.

To help people create lasting positive change in their health and their lives, through accessible, evidence-based tools.

and become part of this journey!

From wheelchair to fully recovered

At Envol, we believe in empowering people to unlock their own inner potential for healing. Our journey began with one mission: to make holistic health accessible to everyone. Founded by Julie Morin and Tim van Driessche, Envol is built on lived experience and a deep understanding of what it means to face health challenges. Julie’s personal recovery from a chronic illness, and her discovery of meditation as a key support tool, inspired Envol’s unique approach, centered on compassion, self-connection, and nervous system regulation.

Based on user feedback and market insights, we will introduce new functionalities and continuously expand our content library (meditations, breathing sessions, and personalized tools).

Germany is currently among our top 3 markets, with significant potential in the field of preventive and digital health.

Launching efficient marketing campaigns to increase Envol’s brand awareness across Europe and grow our user base sustainably.

and become part of this journey!

It’s important to take the time to understand our company before you invest. While investing always carries some level of risk, it typically offers greater potential returns than saving.

What matters most is being well-informed, and the fact that you’re taking the time to learn more on this website is already a good sign.

You can reduce your risk by diversifying your investments.

Never invest money you can’t afford to lose.

It’s not advisable to invest your entire savings, as all investments involve a degree of risk.

Yes, you can. You may already be familiar with the possible risks involved. Corporate bonds are a unique asset class, their risk and return profile cannot be directly compared to other investment products such as shipping funds, government bonds, or real estate and mutual funds.

Registration

You must first register before you can invest.

This can be done as a private individual or on behalf of a company.

Payment

You will receive the bank details immediately after registration, both via a QR code and by email.

If you don’t receive the email, please check your spam folder.

Fully Subscribed

Once the total amount of the bond issue has been reached, it will receive the status “Fully Subscribed”, and no further investments can be made.

Each investment includes a 14-day cooling-off period, during which an investor has the right to modify or cancel their registration.

The bond issue will remain marked as “Fully Subscribed” until the cooling-off period for all registrations has expired.

A prospectus may be exempt from approval by the AFM (Dutch Authority for the Financial Markets) if one or more of the following conditions apply:

The offer is directed to fewer than 150 persons.

The securities can only be acquired (whether individually or in a package) for a minimum value of €100,000 per investor.

The offer of securities is made by a non-profit association or organization in order to achieve its non-commercial objectives.

The nominal value of a security is €100,000 or more.

Crowdfunding involves lending relatively small amounts of money by a large group of investors to a business through an online platform. When lending money to a company, the compensation is interest on the loan. This form is known as loan-based crowdfunding or crowdlending, where financial return is the primary objective.

For most investment offers, a company must either obtain a license or have its prospectus approved by the AFM (Dutch Authority for the Financial Markets).

However, in some cases, exemptions apply, and an investment offer does not fall under AFM supervision.

We then refer to this as an exempt investment.

For example, an investment may be exempt if the total amount that all investors can collectively invest does not exceed €5 million.

(Source: AFM)

No. In crowdfunding, loans are facilitated through a third-party platform that connects lenders and borrowers.

Such a platform is required to conduct a crowdfunding investor assessment for any consumer investing more than €500 through it.

In this case, you are investing directly in the company.

You provide the company with a loan and decide yourself how much you wish to lend.

The terms and conditions of this loan are outlined in the Information Memorandum.

Essential information refers to all the details you need to make an informed investment decision.

Under the Documentation section on this page, you’ll find the legally required information document submitted to the AFM, which includes:

the risks,

securities and guarantees,

loan terms,

tax treatment, and

the company’s current financial situation.

Yes. The AFM considers it important that investors make conscious and informed decisions.

That’s why we provide a reflection period, structured in two ways:

You must actively confirm that you’ve read the Information Memorandum before clicking the purchase button.

You have a 14-day cancellation period, which you can exercise via written confirmation.

There are no costs associated with this cancellation.

If the investment is not cancelled within 14 days, it becomes final thereafter.

Go to the funding website and click the login button at the bottom right of the page. Use your username (email address) and password to access your dashboard.

Please check your spam or junk folder first. If you still haven’t received an email, it’s possible that you’ve been accidentally unsubscribed from the mailing list. In that case, please contact us directly for assistance.

Bondholders who wish to transfer their bonds can do so by submitting a written request to us.

Please feel free to reach out to us at contact@envol.app